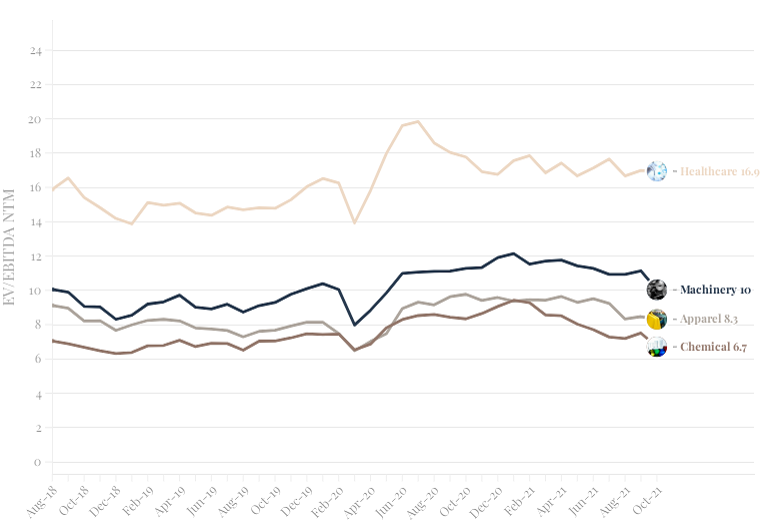

Average earnings multiples range from 2 to 3.5, with the average across all sectors at 2.46. Revenue multiples range from 0.4 to 1.2, with the average across all businesses at 0.63. (For small business valuation purposes, cash flow to the owner (earnings) is a more reliable indicator than revenue .) Industry Sector.. The table below lists the current & historical Enterprise Multiples (EV/EBITDA) by Sector.The multiples are calculated using the 500 largest public U.S. companies.Comparing the current enterprise multiple of a sector/industry to its historical average value can be used to evaluate whether the sector is currently undervalued or overvalued.Note: The ratio is not available for the Financials.

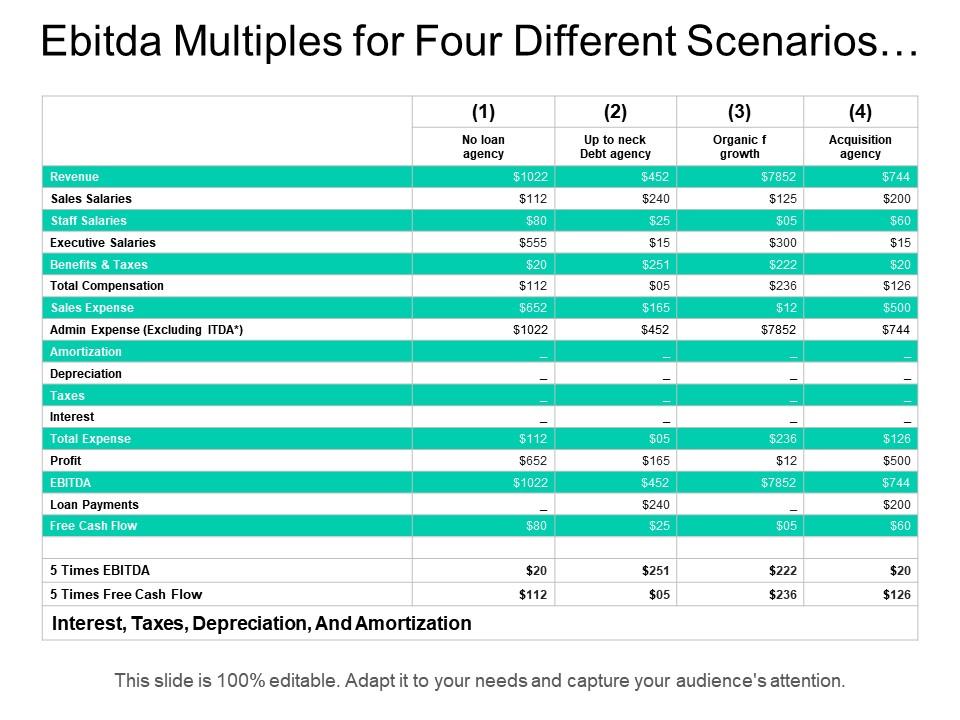

Ebitda Multiples For Four Different Scenarios Of Buying Or Selling Of

EBITDA Multiples By Industry Get The Scoop

EBITDA Multiple For Business Valuation Magnimetrics

![EV/EBITDA Multiple Formula and Calculator [Excel Template] EV/EBITDA Multiple Formula and Calculator [Excel Template]](https://wsp-blog-images.s3.amazonaws.com/uploads/2021/10/01161429/EV-to-EBITDA-Course.jpg)

EV/EBITDA Multiple Formula and Calculator [Excel Template]

Driving the Value of Your Trucking Company Insights KSM (Katz

ebitda multiples by industry Marketing analysis, Industrial, Business

Business valuation multiples by industry Nash Advisory

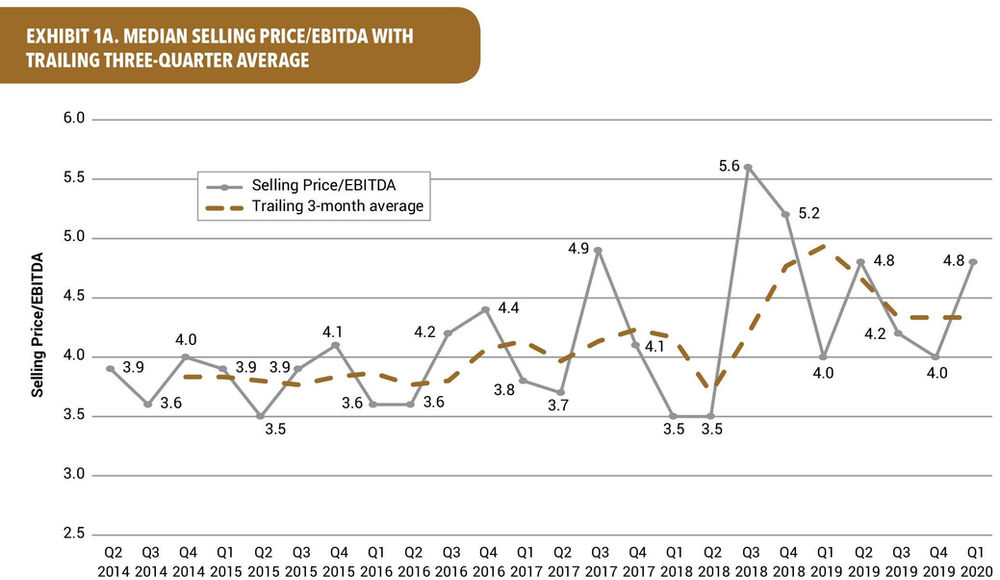

Q1 2020 Market Update EBITDA Multiples Rise in 1st Quarter of 2020

public company ebitda multiples Graphing, Data, Chart

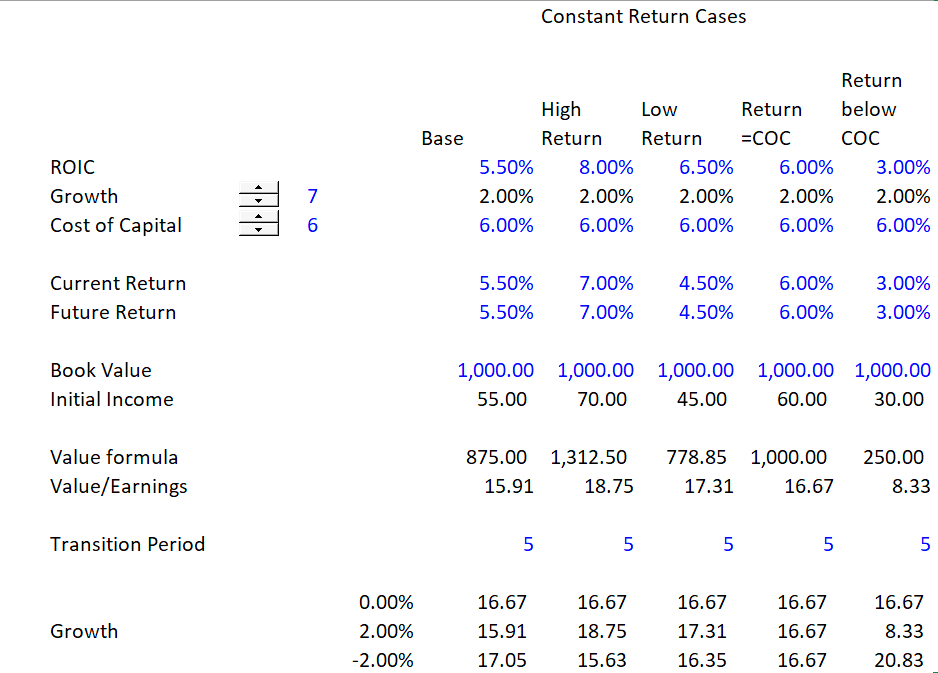

Understanding P/E and EV/EBITDA Multiples Edward Bodmer Project and

Auto Industry Ebitda Multiples Industri Info

EBITDA Multiples by Industry Chart

Trend of the EV/EBITDA multiples in the Healthcare sector BZM

EBITDA Multiple Valuation for Determining Enterprise Value

EBITDA Multiples for Small Businesses 2024 First Page Sage

:max_bytes(150000):strip_icc()/Final6363-d2f19f66845a44fb9d8cdadf11de256b.jpg)

EBITDA/EV Multiple Definition, Example, and Role in Earnings

Auto Industry Ebitda Multiples Industri Info

Service Company EBITDA & Valuation Multiples 2024 Report First Page Sage

What is EBITDA Margin? Formula + Calculator

Value/EBITDA Multiples

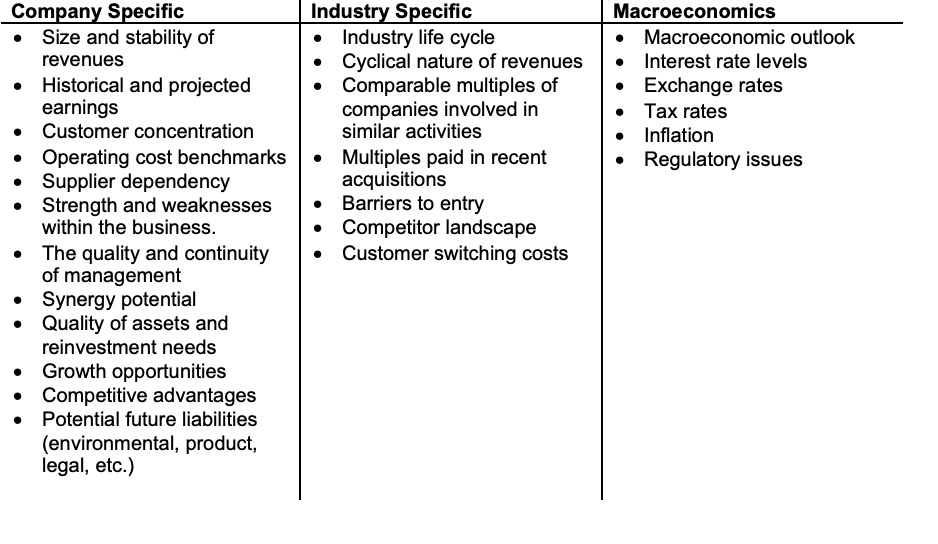

Average EV/EBITDA multiples in the health & pharmaceuticals sector worldwide from 2019 to 2023, by industry [Graph], Leonard N. Stern School of Business, January 5, 2023. [Online].. EBITDA = Earnings before Interest, Taxes, Depreciation and Amortization. Example value calculation using Mean Multiple: Electrical Contractor with $1,000,000 of EBITDA may have a value of $4.6 million based on the mean multiple calculation ($1,000,000 x 4.6). Actual offers from buyers would be expected to fall within the 25-90 percentile ranges.