The costs associated with the process. When you transfer property from personal name into a limited company there will be costs to do so, these may include: Any tax or legal advice you take on setting up a limited company. The cost of registering a limited company with Companies House.. If you're a property owner, get a grip on the tax implications of incorporating your residential property business and transferring your property into a limited company. While it might seem daunting, mastering these specific tips is key to unlocking potential tax benefits. Keep reading to harness tax advantages in your property business.

Capital gains tax on transferring a rental property business into a Limited Company YouTube

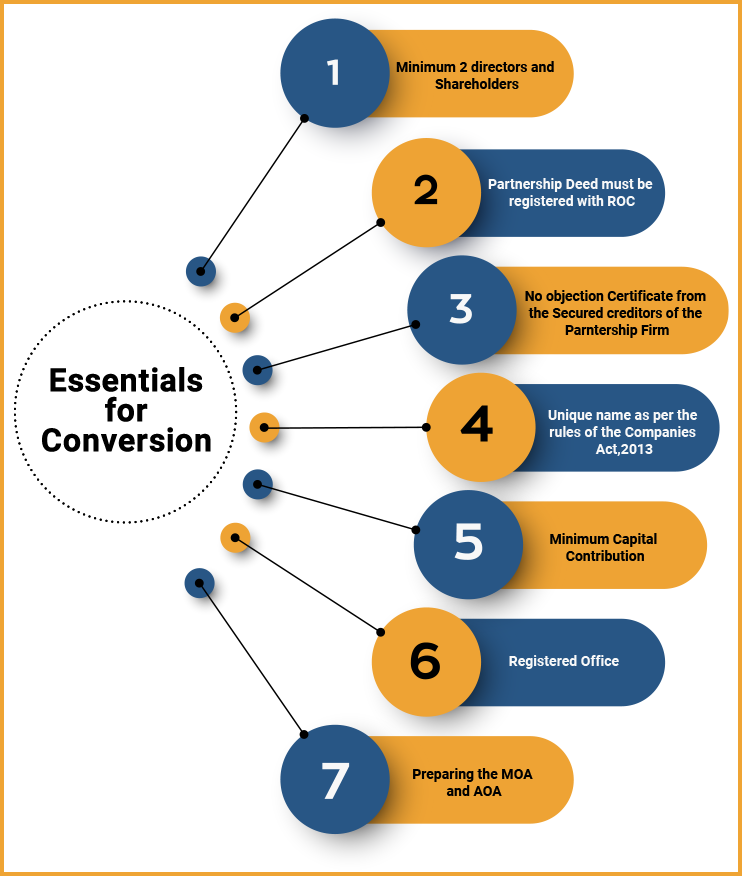

Conversion of Partnership Firm into Private Limited Company

Guide on Transferring Shares in an Irish Limited Company

Transferring property into a trust as a gift or to children. Tax Implications Buy To Let Tax

12 Mistakes Not To Make When Filing Bankruptcy

Guide On Transferring Property Into A Trust

Transferring Property Ownership After Death MoneyVisual

Conversion of Proprietorship to Private Limited Company

convert your Private Limited company to LLP

Should I transfer my buy to let properties into a limited company?

How To Transfer Your Business To Limited Company? Accotax

The tax pros and cons for transferring property into a limited company Buy To Let Tax Accountants

Tips for Successful Private Limited Company Registration Process

Transferring a property in Spain to a Limited Company (SL)

Tax Implications Of Transferring Property Into A Trust The Hive Law

All about Conversion of Partnership to Private Limited Company

Transferring Property into a Company or Partnership Attwells Solicitors

When to consider transferring your buy to let property to a limited company

Transferring Property into a Living Trust An Essential Move to Avoid Probate — Fortune Law Firm

Advantages and disadvantages of a partnership iPleaders

The benefits for transferring a property into a company. Attwells Solicitors support property transfers in Suffolk, Essex & London.. When you transfer a property to a limited company, you may be subject to Capital Gains Tax. CGT is typically triggered when you dispose of an asset, and it applies to the increase in the property's value since you acquired it. However, transferring the property into a limited company may allow you to defer the CGT liability if certain.